Why, Yield Curve & Oil

By Jeff Kelly on October 21, 2022

Many things in life are difficult, if not impossible to explain. In my life I have never understood why I’m not taller. There were 5 boys in our Family. Mike 6’2”, Jim 6’3”, Doug 6’4”, Greg 6’2” and me 6’… well actually more like 5’10”. I brought a date to our house back in the day. After she met a couple of my brothers she asked if it bothered me being so much shorter than my brothers. Not really a question you want from your date. I related this story to my brothers upon returning home and they explained my height issue was the least of my worries when comparing myself to them. They were such confidence builders! I could have done lots of research on genetic makeup and I still wouldn’t have a clue about the height differentials. Maybe it was the mailman! Sometimes we can’t get the clear cause and effect answers we want. This is true about my height versus my brothers and it’s often true in the equity markets.

Our need to know in the equity markets is much more acute when things go poorly. If we own a stock and it’s moving higher every day, we don’t worry much cause it’s about the new products or their “new AI” or the “metaverse”. When they head lower, we start looking much closer at the “why”. Some even want to bring politics into the equation. Answer this question, under what President did U.S. oil production double? If you had Barack Obama, you’d be correct. President Barack Obama was not a fan of oil, but oil production doubled during his time in office. In bear markets the signals rule all else. The why really doesn’t matter. We can spend all of our time trying to figure out the “why” or we can just accept it. A hedge fund liquidating a holding could be the reason for a price decline. Nothing fundamental to products or earnings or anything else.

We will always want to know why. It’s fundamental to our make up as humans. But in this bear market we are much better served following our disciplines than knowing all the whys. Sometimes we will learn the why after the fact. Sometimes not. Chasing the “why” of everything is a waste of energy. In bear markets by the time you get to why, you’ll miss many other opportunities.

Earlier this week in the markets it was the same old same old: Dollar stronger, Yen weaker, interest rates higher, Europe a mess but today, did see something different. Short rates declined as longer rates worked higher. This is new. It can signal a move to normalize the yield curve. It can be a signal we will see smaller interest rate increases going forward. We also saw a break in the strength of the U.S. Dollar. This too could signal less Fed aggressiveness. Or it could just be a blip. Confirmation will be needed in the form of more evidence. We’ll be on the lookout for some other clues. The chart below shows why the dollar is key around the world.

The blue line on the right-hand side chart shows that there is $13.371T of foreign dollar denominated debt (debt that has to be paid in US Dollars).

That is just 64% of US GDP, 91% of China GDP, or 42% of the S&P 500’s market cap (254% of FAANG’s market cap).

CHARTS FROM THE WEEK PAST

Market is tough but we are starting a seasonally better period.

Maybe getting to November brings some relief.

Worrying about exploding rent inflation?

It probably doesn’t have much more to run. Chart shows second differences of the Zillow rent index and the CPI version, lagged six months.

- “Given the massive squeeze on affordability as mortgage rates continue to make fresh highs, and plummeting homebuilder confidence, we see more downside for starts and permits into 1H23.”

- “Mortgage purchase applications & refis plunged to new cycle lows last week.”

- “Prices are finally starting to reflect the sharp deterioration in affordability, with growth in average purchase loan size now down -1.3% y/y.”

Base case: Prices falling at least -5% y/y going into year-end, with downside given tightening financial conditions, and the hawkish Fed.

Lowest prints of this cycle for the housing index.

Mortgage purchase applications at decade lows.

EHS down for an 8th consecutive month, falling -1.5% to fresh 10Y lows at 4.71Mn.

Unit inventory decline outpaced the sales decline, falling -2.34% M/M and taking the month supply lower to 3.18-months.

Median Home Prices slipped -24 bps to +8.07% Y/Y at $391K.

Many IPOs from last year now below offering price.

A very tough year.

This doesn’t include the fixed income movement.

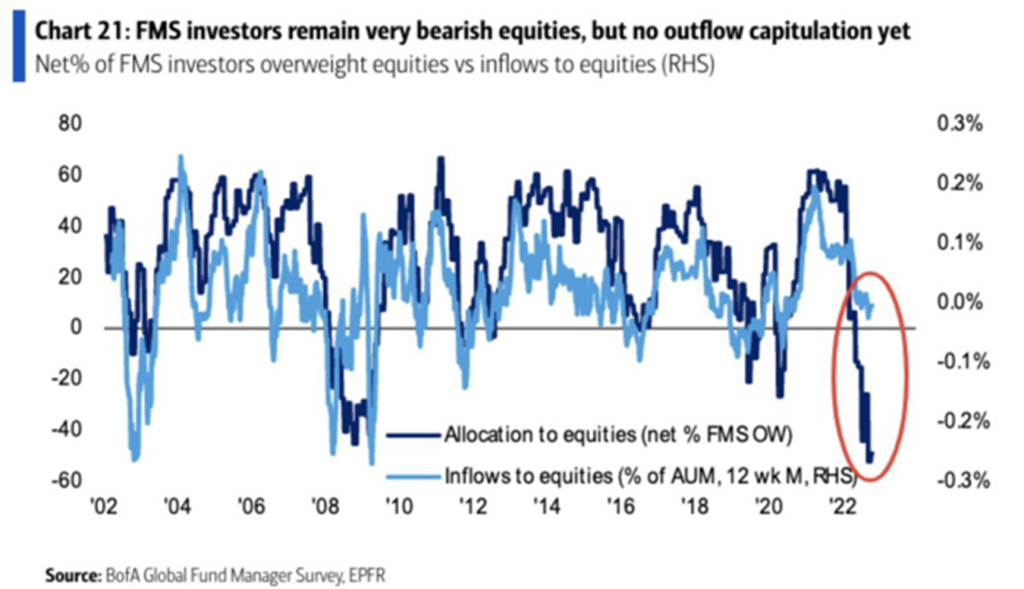

Everyone says they are bearish but have not sold.

Price declines in Housing moving quickly.

Thus far in October, used car prices per Manheim are tanking; year/year rate (-10.4%) is worst since GFC; max drawdown during pandemic (-9.1%) has now been surpassed.

U.K. CPI jumped seas.

Adj. 0.4% m/m in Sep, to 10.1% y/y — highest in roughly 40 years — driven by soaring energy & food prices. Inflation is crushing Real Wages, Confidence, and Consumer Spending (61% of U.K. GDP).

Crazy names on this graphic.

Central Banks are not in the usual place of supporting markets.

The volatility of G10 countries currencies is above the volatility for emerging market currencies.

First time ever. Ever is along time.

Can it be tech has much further to fall?

It has been a historically poor year.

Hiring momentum (darker blue line) is waning.

It leads the jobs data by a couple of months. It’s about to kick in.

You must go back to the Great Financial Crisis (09) to find a September with fewer loaded import containers at the Port of Los Angeles.

They haven’t just fallen off a cliff, they’ve jumped.

Freight rates continue to work lower.

Lots of new lows.

Closing in on the numbers from 2008-09.

We are coming into the best part of the Presidential cycle.

Morgan Stanley sees core inflation on track to decelerate significantly into mid-2023.

The three most important consumer conclusions from last week:

1. Nominal retail sales (ex food & gasoline) are up a healthy 6.5% y/y. But that’s all inflation (ahem, “pricing power”) – exactly what the Fed wants to crush.

2. CPI core goods were flat m/m in Sep, but still up a huge 6.6% y/y … way above the Fed’s 2% broad inflation target. The I/S ratio suggests prices should be coming down. This is an example of sticky inflation.

3. PepsiCo boasted of its “pricing power” last week, when management said they’re fighting inflation by raising prices. The Fed may have something to say about that.

Volatility in bonds and foreign exchange higher than equities.

Another strange part of 2022.

You go to Costco for the free samples, $1 hot dogs and they suck you into buying a bottle of Scotch for 37,000.00.

Another look at the potential for inflation to decline next year.

This is a big deal.

The prohibiting support of certain semiconductor fabs by U.S. persons in China is a real step to push reform. This isn’t the fake tariff stuff from past administrations, which is paid for by U.S. consumers. This goes to the heart of tech manufacturing in China. Like many important things it gets little press coverage.

Quick Take: Taiwan – The Global Tech Bellwether – Is Falling

- “Taiwan Sep export orders fell seas adj -0.7% m/m, to $55.8b – now -18% below their stay-at-home Feb ’22 peak, and down -3.1% y/y (vs -5.0% consensus). This weakness is in line with the falling MSCI All World Tech Hardware & Eqp Index. Reduced demand as we slip into a Global recession, constraining govt tech policies, and cross-strait saber rattling, are all at work.”

- “These export orders include orders taken by Taiwan enterprises for production both in and out of Taiwan, making it one of the best gauges for Global tech (and overall) activity & earnings.”

- “Slackening Global demand, and escalating local geopolitical stress, will keep Taiwan’s TAIEX under pressure, and underperforming MSCI’s All Country World Index.”

- “Falling Taiwan export orders point to weaker world semi sales, and information technology EPS.”

Now they want to buy oil.

ESG has destroyed a lot, BlackRock’s reputation included.

Russian soldiers from their elite unit (equal to our Navy Seals) “beached whales”.

Hell week involves a case of Vodka for all participants.

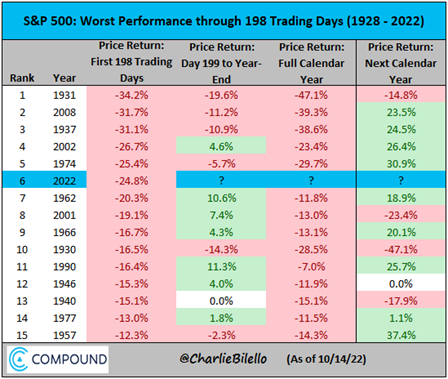

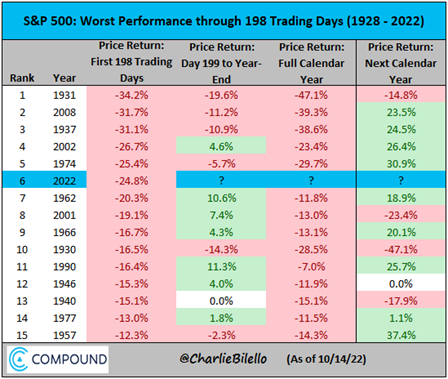

Bad years are often followed by better years.

If it’s not a great depression or World War, 2023 should be better.

WEEKEND HOMEWORK

Erik Townsend and Patrick Ceresna welcome Daniel Lacalle to MacroVoices. Erik and Daniel discuss:

- Energy crisis in Europe

- EU policy makers and their beliefs in efficacy of sanctions

- Nord Stream pipeline sabotage

- What level of hardship is expected in Europe in coming months

- Inflation and demand destruction

- Will energy supply return to pre-pandemic levels?

- Investing in current economic landscape

- Outlook on US dollar

- It ain’t pretty!!

MacroVoices #345 Daniel Lacalle: The Situation in Europe is Worse Than You Think

A book that could be written about today but was about 1918-1922. Filled with much of what divides us today. If only we learned from history instead of trying to deny it occurred.

The nation was on the brink. Mobs burned Black churches to the ground. Courts threw thousands of people into prison for opinions they voiced—in one notable case, only in private. Self-appointed vigilantes executed tens of thousands of citizens’ arrests. Some seventy-five newspapers and magazines were banned from the mail and forced to close. When the government stepped in, it was often to fan the flames.

This was America during and after the Great War: a brief but appalling era blighted by lynching’s, censorship, and the sadistic, sometimes fatal abuse of conscientious objectors in military prisons—a time whose toxic currents of racism, nativism, red-baiting, and contempt for the rule of law then flowed directly through the intervening decades to poison our own. It was a tumultuous period defined by a diverse and colorful cast of characters, some of whom fueled the injustice while others fought against it: from the sphinx-like Woodrow Wilson, to the fiery antiwar advocates Kate Richards O’Hare and Emma Goldman, to labor champion Eugene Debs, to a little-known but ambitious bureaucrat named J. Edgar Hoover, and to an outspoken leftwing agitator—who was in fact Hoover’s star undercover agent. It is a time that we have mostly forgotten about, until now.

In American Midnight, award-winning historian Adam Hochschild brings alive the horrifying yet inspiring four years following the U.S. entry into the First World War, spotlighting forgotten repression while celebrating an unforgettable set of Americans who strove to fix their fractured country—and showing how their struggles still guide us today.

A great fall sports weekend ahead. Let’s go Padres!!! The world with all its faults is out there. You can make a difference in someone’s day. If there’s someone you haven’t spoken to in a while, there’s no time like now. Tomorrow isn’t promised to any of us. Reach out, make their day. It will feel great.

Subscribe

The Kelly & Wohlner Group is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC, member FINRA and SIPC. Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC. All information referenced herein is from sources believed to be reliable. The Kelly & Wohlner Group and Hightower Advisors, LLC have not independently verified the accuracy or completeness of the information contained in this document. The Kelly & Wohlner Group and Hightower Advisors, LLC or any of its affiliates make no representations or warranties, express or implied, as to the accuracy or completeness of the information or for statements or errors or omissions, or results obtained from the use of this information. The Kelly & Wohlner Group and Hightower Advisors, LLC or any of its affiliates assume no liability for any action made or taken in reliance on or relating in any way to the information. This document and the materials contained herein were created for informational purposes only; the opinions expressed are solely those of the author(s), and do not represent those of Hightower Advisors, LLC or any of its affiliates. The Kelly & Wohlner Group and Hightower Advisors, LLC or any of its affiliates do not provide tax or legal advice. This material was not intended or written to be used or presented to any entity as tax or legal advice. Clients are urged to consult their tax and/or legal advisor for related questions.

10488 W. Centennial

Ste. 302

Littleton, CO 80127

Office: (303) 800-5250

Toll free: (888) 257-8629

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

© 2025 Hightower Advisors. All Rights Reserved.